Cost of Copper Per Ton: A Comprehensive Overview

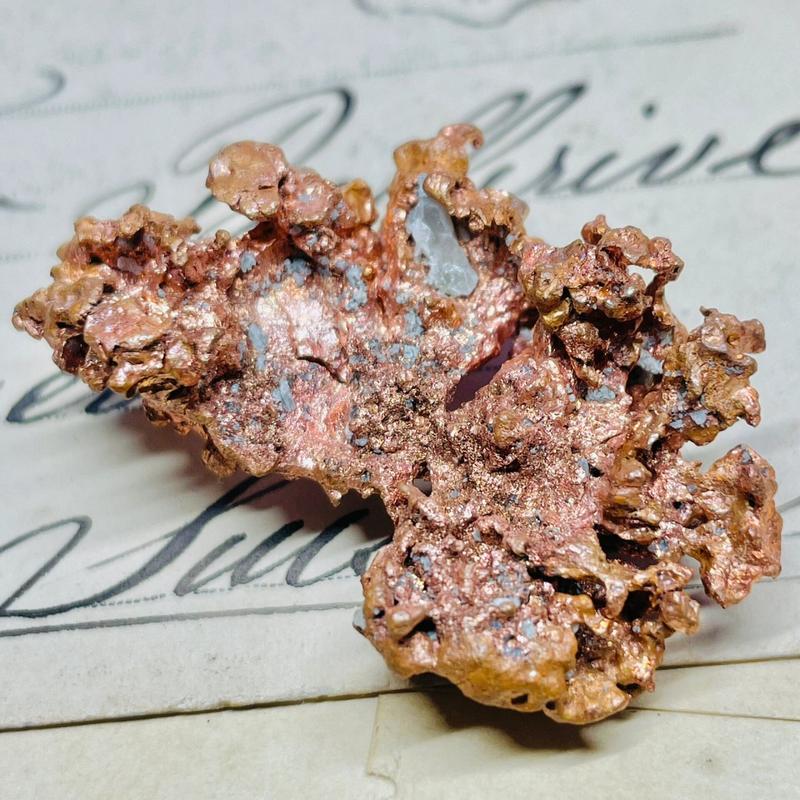

Understanding the cost of copper per ton is crucial for businesses and investors in the metal industry. Copper, known for its versatility and conductivity, is widely used in various sectors, including construction, electrical engineering, and manufacturing. This article delves into the factors influencing the price of copper, its historical trends, and the current market scenario.

Market Dynamics

The cost of copper per ton is influenced by several factors, including supply and demand dynamics, production costs, and global economic conditions. Let’s explore these factors in detail.

| Factor | Description |

|---|---|

| Supply and Demand | The balance between copper production and consumption significantly impacts its price. An increase in demand or a decrease in supply can lead to higher prices, while the opposite scenario can result in lower prices. |

| Production Costs | Production costs, including mining, refining, and transportation expenses, play a vital role in determining the price of copper. Higher production costs can lead to increased prices, while lower costs can result in lower prices. |

| Global Economic Conditions | Economic growth or contraction in major economies, such as China and the United States, can significantly impact the demand for copper. A strong economy often leads to higher demand and, consequently, higher prices. |

Historical Trends

Looking at the historical trends of copper prices can provide valuable insights into its price movements. Let’s explore some key trends over the past few decades.

Over the past few decades, the price of copper has experienced several fluctuations. In the 1980s and 1990s, copper prices were relatively stable, ranging between $1,000 and $2,000 per ton. However, in the early 2000s, prices started to rise significantly, reaching a peak of around $8,000 per ton in 2008. Since then, prices have experienced a downward trend, but they have remained relatively high compared to the 1980s and 1990s.

Current Market Scenario

As of now, the cost of copper per ton is influenced by various factors, including global economic conditions, supply and demand dynamics, and production costs. Let’s take a closer look at these factors.

Global Economic Conditions:

The global economic landscape has been volatile in recent years, with various economies experiencing both growth and contraction. The United States and China, being the world’s two largest economies, have a significant impact on the demand for copper. As these economies recover from the COVID-19 pandemic, the demand for copper is expected to increase, potentially leading to higher prices.

Supply and Demand Dynamics:

The supply of copper is influenced by mining operations worldwide. Major copper-producing countries, such as Chile, Peru, and the United States, have been experiencing challenges in increasing production capacity. Additionally, the global copper market has been facing supply disruptions due to geopolitical tensions and labor strikes. These factors have contributed to higher copper prices.

Production Costs:

Production costs have also played a role in determining the price of copper. Mining companies have been investing in new technologies and methods to improve efficiency and reduce costs. However, the rising cost of raw materials, such as coal and oil, has put pressure on production costs, leading to higher prices for copper.

Conclusion

In conclusion, the cost of copper per ton is influenced by various factors, including supply and demand dynamics, production costs, and global economic conditions. Understanding these factors can help businesses and investors make informed decisions regarding copper purchases and investments. As the global economy continues to recover, the demand for copper is expected to increase, potentially leading to higher prices in the near future.